Reclaim Your Billable Hours From Admin

Tax return queries, document chasing, BAS reminders - your AI assistant handles the repetitive calls so you can focus on complex property advisory work that clients actually pay for.

AI That Understands Property Accounting

From document collection to BAS reminders, AI handles the repetitive work that consumes your practice hours.

Tax Return Inquiries

Clients calling about their return status, negative gearing claims, or refund timelines? AI handles the routine questions so you can focus on complex advisory work.

- Return status updates

- Deduction eligibility queries

- Refund timeline information

- EOFY deadline reminders

Document Collection

Chase missing documents automatically. AI calls clients about outstanding settlement statements, rental summaries, and expense receipts - no more admin hours wasted.

- Automated document reminders

- Outstanding items follow-up

- Rental statement requests

- Receipt collection prompts

Property Purchase Support

When clients are buying or selling investment properties, AI captures the details and schedules urgent consultations for CGT planning and structuring advice.

- Purchase inquiry intake

- CGT calculation queries

- Entity structuring questions

- Urgent consultation scheduling

Appointment Scheduling

End of financial year rush? AI books consultations, sends reminders, and handles reschedules - keeping your calendar optimized without the phone tag.

- Tax planning appointments

- EOFY review bookings

- Portfolio review scheduling

- Confirmation and reminders

Deadline Reminders

Proactively reach out to clients before BAS deadlines, PAYG instalments, and tax lodgement dates. Never let a client cop an ATO penalty.

- BAS deadline reminders

- PAYG instalment alerts

- Tax lodgement notifications

- Land tax due dates

Depreciation Queries

Handle questions about QS reports, Division 43 deductions, and plant & equipment write-offs. AI captures property details and books valuations when needed.

- Schedule status inquiries

- Plant & equipment questions

- QS report ordering

- New property assessments

Scrub Your Data Before Wasting a Dollar

Contact Cleaner (This Alone Justifies the Cost)

Before any call goes out, we automatically:

- Scan your entire contact database

- Remove invalid phone numbers and emails

- Eliminate duplicates

- Flag dodgy entries

- Prevent wasted calls before they happen

Other platforms let you discover bad data after you've paid.

We catch it before the first dial.

$28,000+

Sounds Like Someone From Sydney or Melbourne

Not offshore. Not robotic. A genuine Aussie voice that builds instant trust.

True-Blue Aussie Voice

Your customers hear a familiar Australian accent—like they're talking to someone local.

- No American twang

- No offshore accents

- No robotic phrasing

- Sounds local, feels trusted

Zero Latency

Calls route through local infrastructure. That means:

- No lag

- No talking over each other

- No frustration

It feels instant because it is.

Natural Conversations

This isn't IVR. This isn't "press 1 to continue".

Your agent understands context and responds naturally. People stay on the line because it feels genuine.

Built for Australian Property Accountants

Industry-specific training ensures your AI handles property investor queries with the right terminology and context.

ATO Compliance Aware

AI trained on Australian tax terminology. Understands negative gearing, CGT, Division 43, land tax, and depreciation schedules for property investors.

Instant Response

Clients calling during tax season expect answers. AI responds in under 500ms, handling routine queries before they clog your workflow.

Query Classification

Every call is categorized - urgent, complex, or routine. Complex matters are flagged for your immediate attention with full context.

Multi-Property Handling

AI tracks client portfolios, understanding which properties are residential, commercial, or SMSF-held for appropriate query routing.

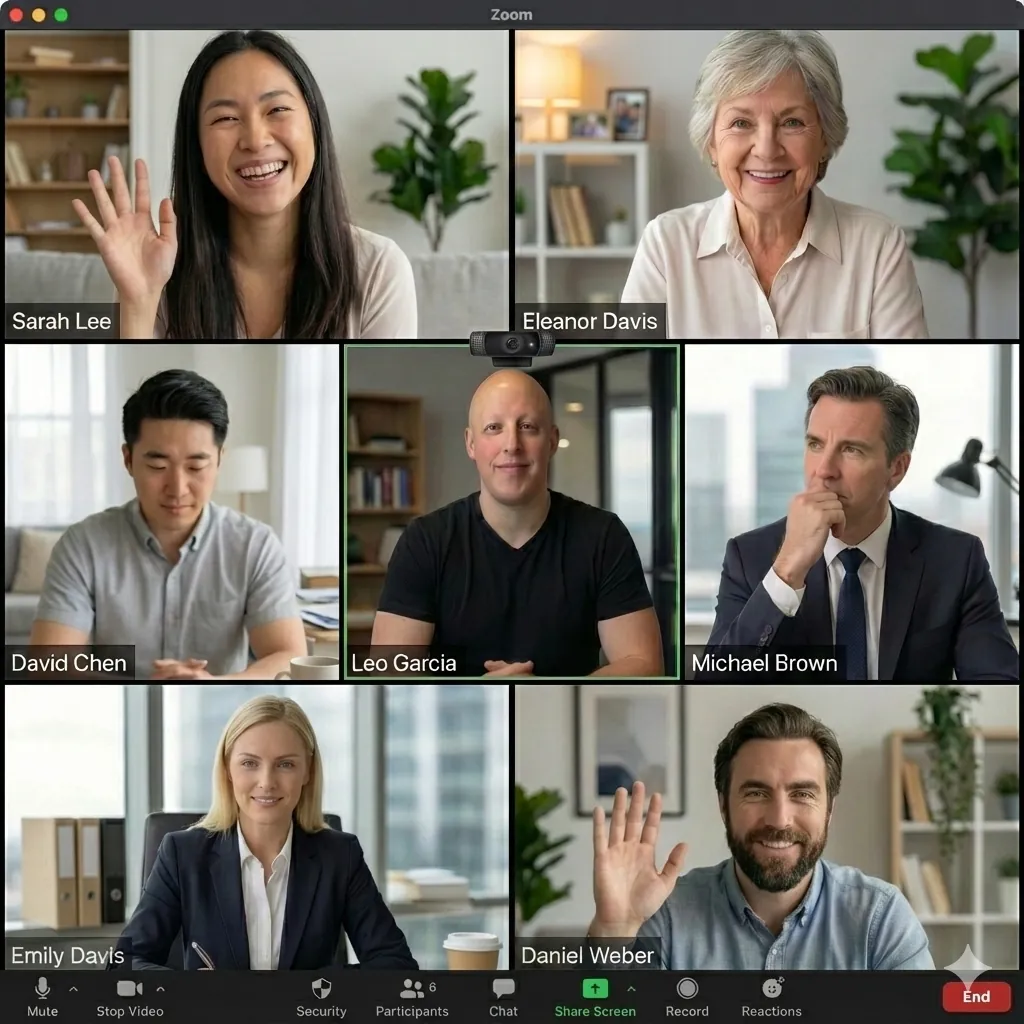

Talk To Our Property Law Expert AI

This is a live test. Ask anything about property law, real estate transactions, buying or selling property in New Zealand. Experience how natural our AI agents sound.

Click the button below to start a voice conversation. Your microphone will be activated.

Property Law Expert

AI Sales Agent

Specializing in NZ property law, transactions, and real estate advice

Allow microphone access when prompted

Ask About Property Law

Questions about buying, selling, or property rights

Test Naturalness

See how human-like our AI agents sound

Experience AI

This is the same tech your buyers will interact with

Impressed? This is how your buyers will experience your AI agent.

Ready to automate your inquiries? See pricing below

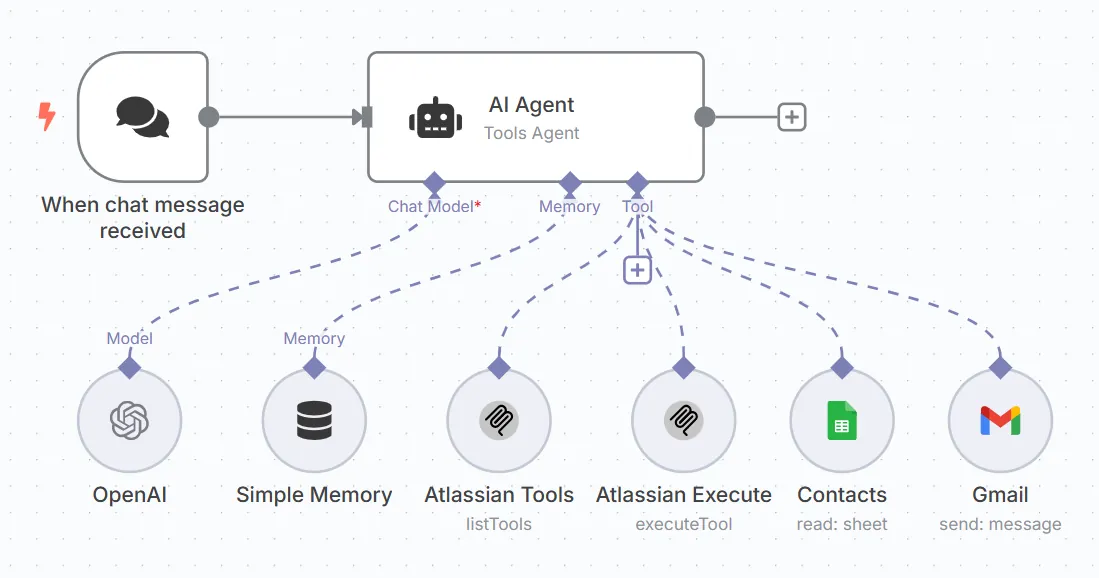

Connects With Your Practice Tools

Seamless integration with the accounting software and practice management tools Australian firms actually use.

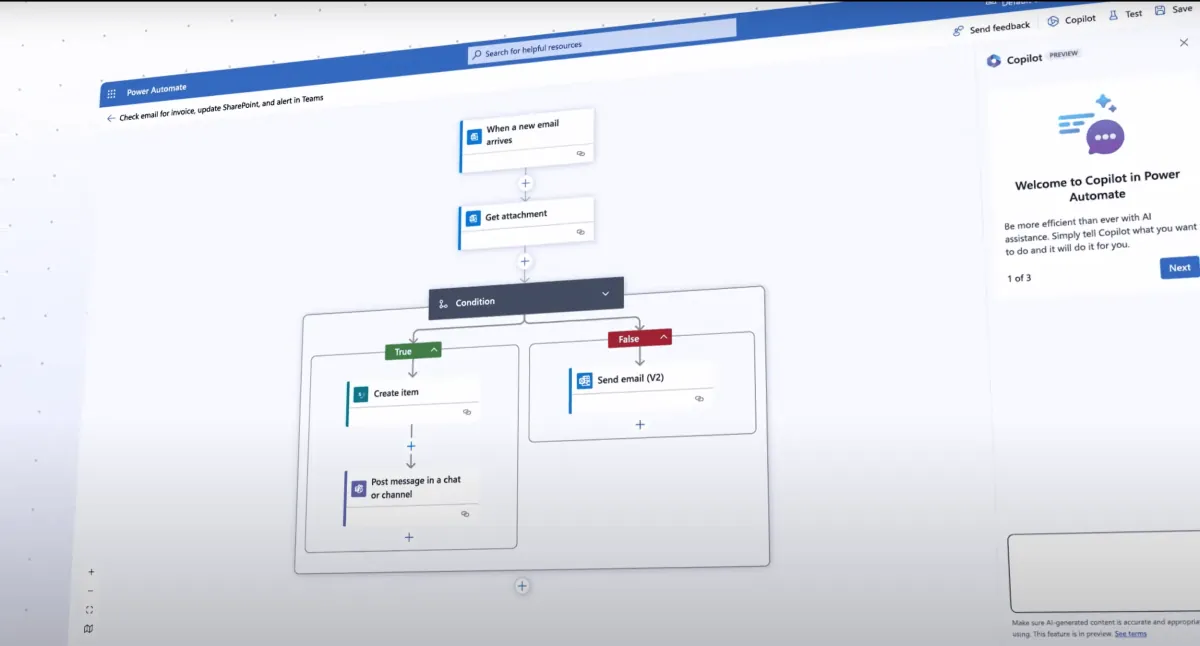

Take Control of Every Call

Our portal puts you in the driver's seat. Launch campaigns, track results, and fine-tune your AI agents - all from one powerful dashboard.

$1.27

Cost per Booking

Run Your Own Campaigns

Launch outbound campaigns in minutes. Set schedules, concurrent calls, and watch results in real-time.

Native NZ Accent

Your AI speaks like a Kiwi. Natural, warm, and familiar to your local customers.

Brand Knowledge Base

Upload your docs, FAQs, and product info. Your agent knows your business inside out.

Custom Agent Scripts

Design conversation flows your way. No coding required - just describe what you want.

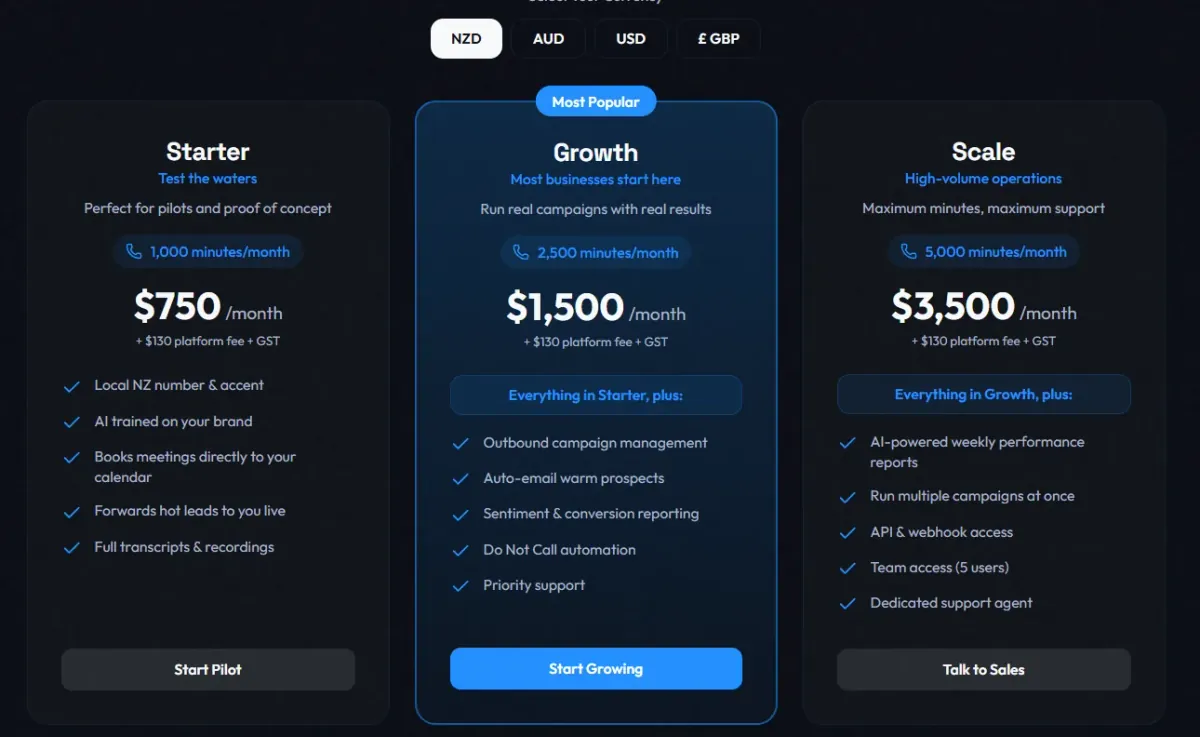

Pricing for Property Accountants

Reclaim 10+ billable hours per week. The ROI speaks for itself.

Solo Practice Plan

- Up to 200 calls/month

- Document collection campaigns

- Xero/MYOB integration

- Appointment booking

- Call transcripts & summaries

- Email support

Multi-Partner Plan

- Unlimited calls

- Multi-partner routing

- Client portfolio segmentation

- Practice management integration

- Custom workflows per service

- Dedicated support

Frequently Asked Questions

Common questions from Australian property accountants about AI voice agents.

Can AI really handle property tax questions?

Yes, for routine queries. The AI is trained on Australian property tax concepts - negative gearing, CGT, main residence exemption, depreciation. It handles status inquiries and general questions, escalating complex advisory matters to you with full context notes.

How does the AI collect missing documents?

You provide a list of outstanding items per client. AI calls them with friendly reminders, notes their response (sending today, need extension, don't have it), and updates your system. No more chasing emails or playing phone tag.

Will clients know they're talking to AI?

The AI uses a natural Aussie voice and has genuine conversations. While we recommend transparency, many clients appreciate the immediate response regardless. The AI can introduce itself as your practice assistant, depending on your preference.

What about complex CGT calculations?

The AI never gives specific tax advice - it captures the question, notes the property details and dates, and schedules a consultation with you. It's designed to triage and gather information, not replace professional advice.

How does it handle SMSF property queries?

You can tag clients by property ownership structure (personal, company, trust, SMSF). The AI adjusts its responses accordingly and routes queries to appropriate team members who specialize in that area.

Can it help during EOFY peak?

That's when AI shines most. While you're buried in returns, AI handles the flood of status inquiries, deadline questions, and document chasing that would otherwise eat your billable hours.

New Zealand & Australia's Leading AI Agency

We don't just talk about AI—we implement it. Waboom has helped businesses across NZ and Australia identify bottlenecks and deploy AI solutions that actually work.

Trained teams at NZ's leading companies

From boardrooms to conference stages. Practical AI that teams actually use.

Guest Speaker

Xero AI Training

Dad's Pies Training

ChatGPT Demo

Corporate Training

Hybrid Session

Want the Complete Guide?

Learn everything about AI voice agents for real estate—compliance, setup, inbound vs outbound strategies, and best practices for NZ and Australia.

Read the Ultimate Guide->Stop Chasing Documents Manually

Every hour spent on admin calls is an hour you're not billing. Let AI handle the routine while you focus on high-value advisory work.